Accelerate financial institutions’ business growth with PROFITS® for Credit Unions & Cooperative Banks (e.g. SACCOs), a ready-to-deploy Core Banking Solution tailored to meet the needs and expectations of banks, covering their business, operational and regulatory needs across Africa in a fast and secure manner, providing them with a reliable platform to scale and serve their members through frictionless digital solutions.

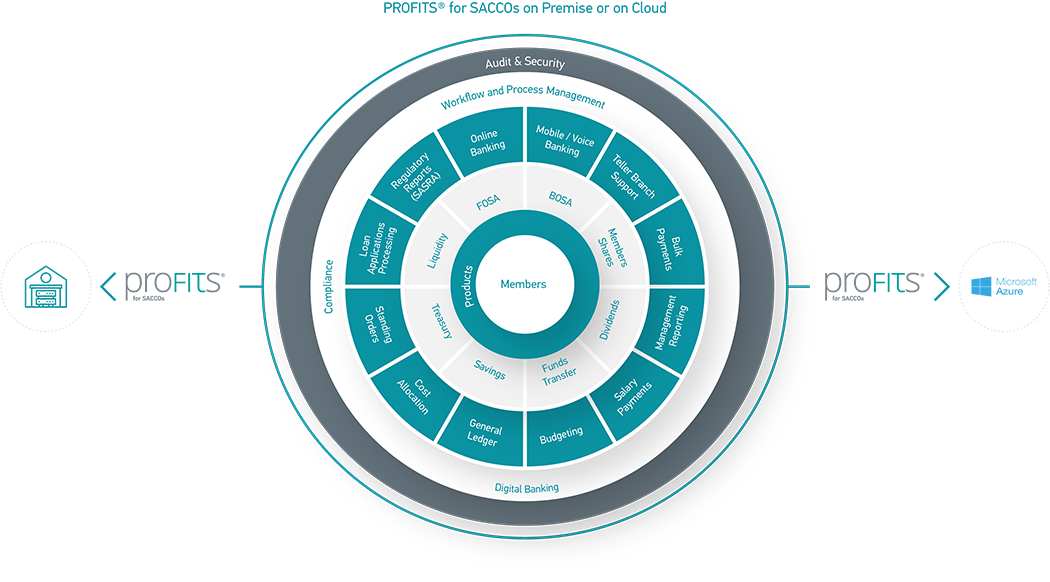

PROFITS® for Credit Unions & Cooperative Banks (e.g. SACCOs) is designed as an integrated packaged solution, providing rich comprehensive functionality that covers core and near core business functions on an end-to-end basis.

Through its advanced and customer-centric concept, PROFITS® for Credit Unions & Cooperative Banks (e.g. SACCOs) allows for easy and personalised management of organisations’ relationship with their members, improving customer service and creating more opportunities for business growth.

Find in PROFITS® for Credit Unions & Cooperative Banks (e.g. SACCOs) a robust and reliable solution for developing business resilience and adapt to the rapid changes and member’s financial behaviours to ensure current and future growth.

Provide members with advanced and frictionless digital channels that embrace a mobile-first approach (mobile apps or USSD banking) offering them convenience and simplicity.

Allow financial institutions’ members to easily access their money to make fast and secure fund transfers to other Credit Union accounts and pay their bills without having to visit local points of service.

Provide convenience for organisations’ members, giving them whatever they need, whenever they need it. Members can get their micro-loans directly on their phones

With PROFITS® for Credit Unions & Cooperative Banks banks will understand and satisfy their members need for quick and convenient services delivery, operating in a fast, efficient and cost-effective manner to come up with better products and solutions for them.

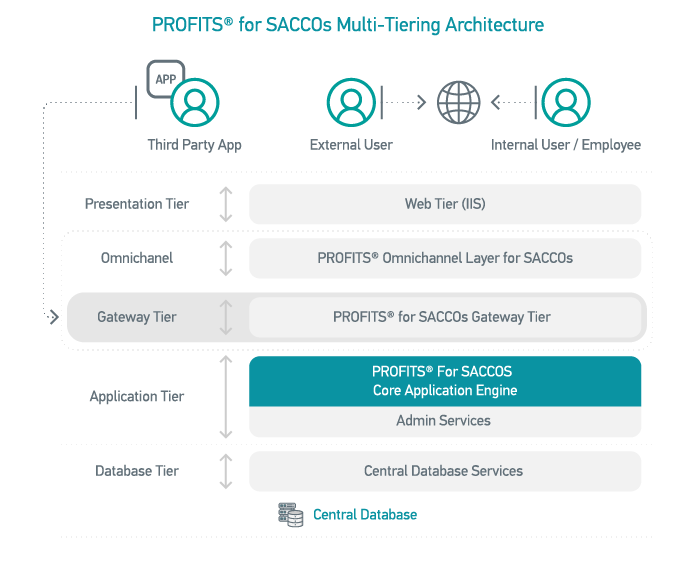

PROFITS® for Credit Unions & Cooperative Banks (e.g. SACCOs) is being delivered on Cloud SaaS to help banks speed up digital efficiency and resilience, as well as for financial support to internal costs and processes. With PROFITS® for Credit Unions & Cooperative Banks (e.g. SACCOs) on Cloud SaaS banks will avoid upfront investment related to licenses and implementation services, infrastructure and maintenance costs, and the need for allocating specialized IT personnel.

Netcompany-Intrasoft has available a robust and comprehensive Credit Unions and Cooperative's - specific regulatory compliance framework, covering regulations of local societies regulatory authorities (like SASRA in Kenya), even in Africa or other region. PROFITS® for Credit Unions and Cooperatives Reporting Framework ensures fast and efficient composing and management of regular reporting, as well as the enhancement and customization of reports on time, according to recurring changes published by local regulatory authorities.

Our Software applications are designed with security by design, under a robust framework of security principles, ensuring their Secure Software Lifestyle (SSDLC).