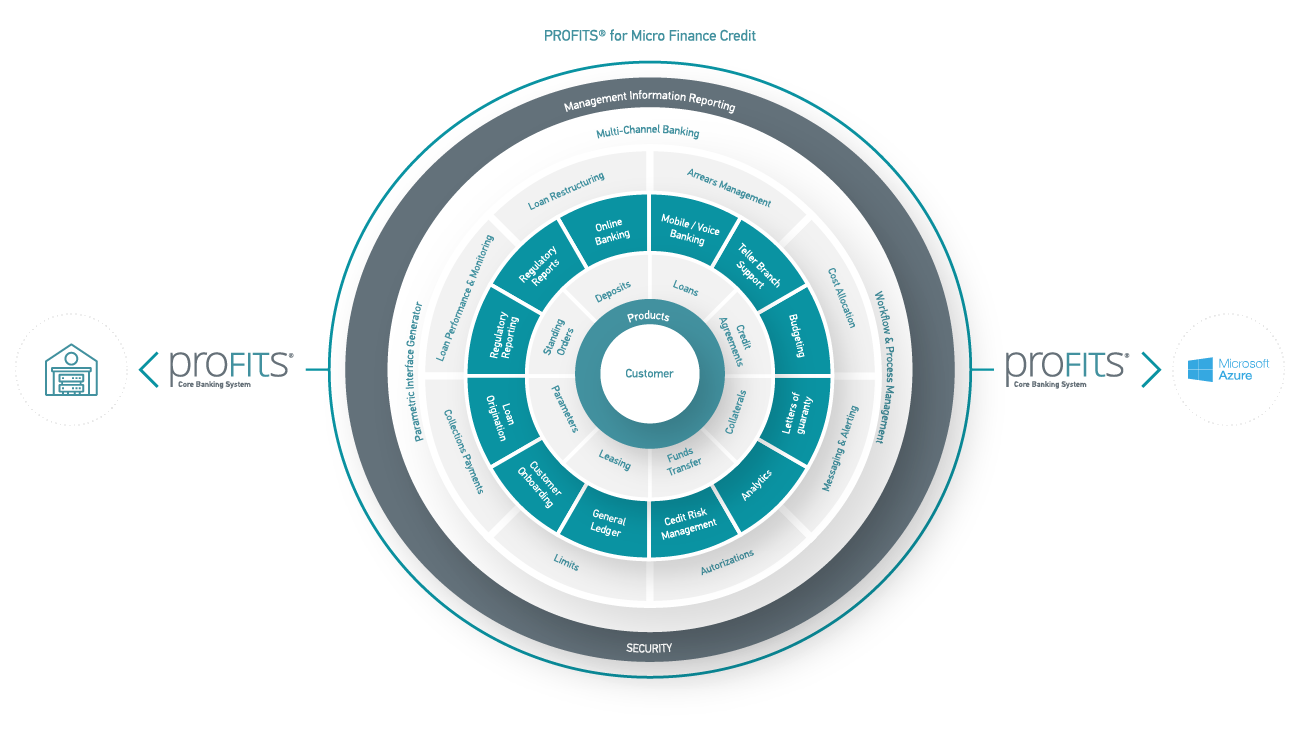

PROFITS® Micro Finance Credit helps to accelerate business growth, as a ready to deploy Core Banking Solution tailored to meet the needs and expectations of Micro Finance Credit institutions. PROFITS® Micro Finance Credit automates most processes, allowing them scale up without extra manpower, while cutting out most user intervention and embracing innovation in processes and data capture.

PROFITS® Micro Finance Credit provides out-of-the box digital features for mobile and web banking, letting customers enjoy better experiences through a modern and fresh UI. Easy navigation, frictionless customer journeys, and precise options for users are guaranteed, while dashboards modelled on customers digital behavior are provided to ensure a 360degree view of loan products and financial information.

PROFITS® Micro Finance Credit provides a frictionless digital onboarding process, utilising digital signatures and document storage features. Micro Finance Credit institutions can take advantage of a robust, simplified, and secure processes to get customers onboard fast and efficiently to provide an advanced digital experience, which is a critical differentiator in the increasingly competitive market.

PROFITS® Micro Finance Credit delivers the most advanced loan application process, ensuring a frictionless digital-first experience and removing obstacles: starting from loan application by the borrower, submission of appropriate documentation, assessment of the application, credit risk management and ending with the final funding of the loan.

PROFITS® Micro Finance Credit comes with robust features for credit risk management that help streamline processes and make faster commercial lending decisions. Its core capabilities include credit limit assessment, estimated late payment and expected losses calculation, as well as credit policy planning, monitoring, simulation and much more.

PROFITS® Micro Finance Credit enables us to create and bring new products rapidly to market with less coding, allowing business analysts to make rapid changes and fit the solution to the needs of any Micro Finance Credit Institution. Easy integration with third party systems and applications for key services like credit evaluation, AML, fraud detection and prevention and more is guaranteed.

PROFITS® Micro Finance Credit creates and configures standard and ad hoc regulatory reports, as well as reports for internal use. Aggregation of data and credit risk analysis are guaranteed at any portfolio or bank level.

PROFITS® Micro Credit Finance provides more to financial inclusion than microcredit, credit scoring, loan origination and restructuring. Payments, transfers, remittances and many more transactions help customers to manage their intraday finances, creating options to define opportunities for up-sell and cross-sell.

PROFITS® Micro Finance Credit is being delivered on Cloud SaaS to help Micro Finance Credit Institutions speed up digital efficiency and resilience, as well as for economic relief to internal costs and processes. With PROFITS® Micro Finance Credit on Cloud SaaS upfront investment related to licenses and implementation services can be avoided, as well as infrastructure cost, maintenance cost, and the need for allocating specialized IT personnel.

Netcompany-Intrasoft has available a robust and comprehensive regulatory compliance reporting framework for Micro Finance - Credit institutions, ensuring that changes in key market standards are applied on time. PROFITS® Core Banking provides to its staging area any data required by any local regulator, providing the option to be consolidated by Netcompany-Intrasoft's Reporting Framework, or by third party regulatory reporting tools, and be seamlessly delivered to local regulators, or supervisory bodies. Netcompany-Intrasoft's vast expertise in the field, ensures that through PROFITS® Core Banking clients can manage complex obligations and respond efficiently and effectively to regulatory authorities.

Our Software applications are designed with security by design, under a robust framework of security principles, ensuring their Secure Software Lifestyle (SSDLC).