PROFITS® for Retail & Corporate Banks is the platform of choice for a significant number of retail and corporate banks around the world, helping to take the cost and complexity out of technology. With PROFITS® for Retail & Corporate Banks financial institutions will industrialise their business processes, adopt new distribution strategies, implement key enterprise capabilities and be fast to market. PROFITS® for Retail & Corporate Banks is designed according to the highest security specifications and international quality standards, having an open and solid architecture that ensures agility, scalability, and resilience and is available on Cloud as a SaaS model, or as a standard on-premise implementation.

One platform aims to provide seamless customer experience across channels, focusing on interaction, while providing personalised customer experience across all digital and physical touchpoints. All digital channels utilise a consistent and frictionless look and feel as transactions are performed seamlessly across all channels, while interactions between digital channels and 3rd party systems and applications are performed through a single omnichannel gateway.

PROFITS® for Retail & Corporate Banks enables banks and financial institutions to rapidly create an integrated ecosystem of digital experiences across all end-user channels. Digital Experience helps banks execute their digital strategies, utilising a various channels approach to provide a full set of web and mobile banking applications. With e-Branch banks can cater to their branch users’ needs, in ways that were never previously possible.

A single customer view that covers all product lines and channels and enhances the ability of the bank to understand its customers’ needs and enhance personalisation of services. Embedded analytics provide customer insight, predictive sales, and service assistance. Banks may have the opportunity for business growth through an advanced customer profile concept and the effective management of information of the customer’s financial relationship with the bank.

PROFITS® for Retail & Corporate Banks modern and highly flexible Product Factory allows the creation and servicing of any type of retail and corporate banking product, ensuring fast creation and delivery whenever new opportunities arise. Products and services can be delivered and promoted individually or as product or service packages. PROFITS® for Retail & Corporate Banks supports simple banking products, such as Deposits and Loans, varying from simple offerings to more sophisticated and complex structures. PROFITS® for Retail & Corporate Banks comes with a complete set of out-of-the-box banking products, which can be easily and rapidly modified to adopt the Bank’s policies.

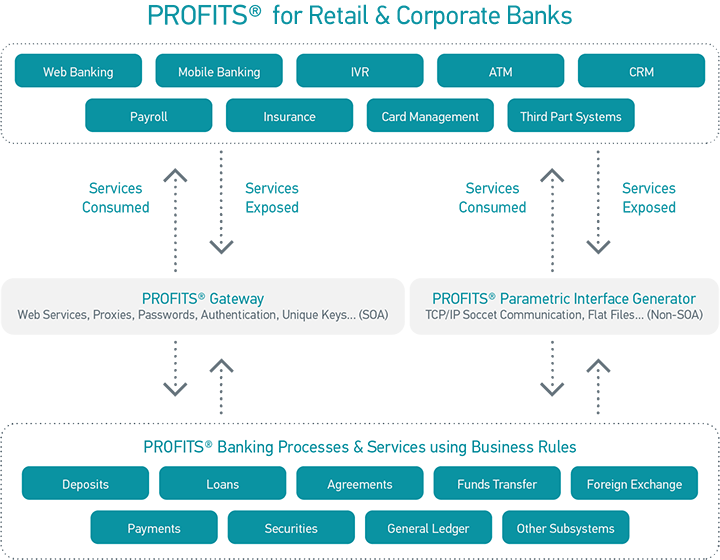

Our Business Rules engine is a fundamental architectural concept of PROFITS® for Retail & Corporate Banks, ensuring a high degree of automation to the setup of all PROFITS® for Retail & Corporate Banks components, thus reducing time to market to the minimum possible. It is used across every subsystem of PROFITS® for Retail & Corporate Banks, driving the dynamic definition (by configurable services) of application logic and interfacing with 3rd party systems and applications.

PROFITS® for Retail & Corporate Banks open architecture delivers the agility and ability to integrate and innovate, having available a significant number of powerful APIs that are accessible by third-party systems and applications, providing efficiency to conduct integrations, which cover all areas of banking and finance business. Moreover, PROFITS® for Retail & Corporate Banks can provide a rich set of integration features in readymade web services or any type of file exchange and messages modes.

PROFITS® for Retail & Corporate Banks can be deployed in a variety of technological platforms, Mainframe, Unix, Microsoft environments and Relational Database Systems, such as DB2, Oracle, SQL Server.

We embrace a modular architecture that allows financial institutions to easily roll out new offerings and scale them vertically or horizontally rapidly and in line with their customer needs, empowering them to accelerate market response. Our platform consists of a full set of components, seamlessly integrated with each other and covering all core and near core banking functionality, such as ERP functionality, in a modular manner. Due to this architecture PROFITS® can be installed either fully, or componentised, utilising embedded or additional components that are all governed by the same architectural and integration principles.

Our robust core banking solution provides efficient embedded applications, features, and toolkits, such as PROFITS® for Retail & Corporate Banks Messaging and Alerting that offer a complete messaging ecosystem, PROFITS® for Retail & Corporate Banks Scheduler, a full Workload Automation System offering the ability to easily configure complex workloads, security control upon execution of scheduled tasks, and much more. PROFITS® for Retail & Corporate Banks also comes with its own Data Migration Toolkit, Testing Facility, Configuration Management features.

Netcompany-Intrasoft has available a robust and comprehensive regulatory compliance reporting framework, ensuring that changes in key market standards are applied on time. PROFITS® for Retail & Corporate Banks provides to its staging area any data required by any local regulator and supervisory body, providing the option to be consolidated by Netcompany-Intrasoft's Reporting Framework, or by third party regulatory reporting tools, and be seamlessly delivered to any supervisory authority. Netcompany-Intrasoft's vast expertise in the field, ensures that through PROFITS® for Retail & Corporate Banks, clients can manage complex obligations and respond efficiently and effectively to regulatory stakeholders.

Our Software applications are designed with security by design, under a robust framework of security principles, ensuring their Secure Software Lifestyle (SSDLC).